White Paper

The Complete Guide to a Business Line of Credit for Fleet: Access to Working Capital for Business Growth

07/18/2025

If vehicles are essential to your business, access to financing at the right time makes all the difference. Consider the following scenarios:

- A construction company just won a lucrative bid and needs to add new vehicles immediately.

- A plumbing business stalls when a van breaks down, with no cash to replace it.

- A delivery business faces rising fuel costs, but upgrading to more efficient vehicles could mean a disruption to other key operations.

Managing a business with a fleet requires balancing cash flow, growth opportunities and vehicle availability. Your ability to respond to these financial challenges can be the difference between moving forward and standing still.

Traditional vehicle financing options have their place, but they're not designed for the dynamic situations many fleet-reliant businesses face. Fleet managers often need to move quickly to keep business moving forward, so they need a flexible financing solution for funding new vehicles or fleet-related costs.

This comprehensive guide is designed to help you understand and implement a business line of credit for your fleet. You'll discover how it differs from traditional financing options, the advantages it offers for cash flow management, the application process, ways to use it effectively and how it helps build business credit. Also included are comparisons with other financing options to help you determine the best move for your business.

By the end of this guide, you'll have the knowledge to transform your fleet financing from a series of reactive transactions into a strategic advantage that drives business growth. Let's start with the basics.

Part 1: Foundations and Fundamentals

This section establishes an essential knowledge base for understanding fleet-specific lines of credit. You’ll discover what makes a line of credit uniquely suited for vehicle-dependent businesses, its strategic advantages for managing cash flow challenges and how to apply.

Understanding business lines of credit for fleet

Before exploring the specific applications for your fleet business, let's discuss what a line of credit is and how it differs from other financing options.

What is a line of credit?

A line of credit allows a business to leverage available credit that can be accessed as needed. You can borrow up to your established credit limit, repay what you use, and then borrow again without reapplying.

Lines of credit vs. working capital loans

For businesses that need quick and reliable access to cash, the advantages of a line of credit become clear when compared to traditional financing options. Here are some key differences:

- Access to funds: With a line of credit, you draw only what you need when you need it, rather than receiving a one-time lump sum as with working capital loans. This on-demand approach means you can cover expenses without borrowing more than you need or having to reapply for every purchase.

- Payment structure: Working capital loans require fixed monthly payments on the entire lump sum. Line of credit payments are based only on the amount you use. You can also pay more during profitable seasons and less during downturns to match your cash flow.

- Approval process: A line of credit requires a one-time approval for ongoing access to funds. A working capital loan needs a new application, documentation and approval for every borrowing request, costing you time and potential opportunities for your business.

- Interest costs: With working capital loans, you pay interest on the entire borrowed amount from day one. With a line of credit, you only pay interest 1 on the funds you use.

- Renewal and reassessment: Once approved, working capital loans are rarely reassessed, locking you into the initial terms, even as your business grows. Lines of credit typically undergo annual reviews, making it possible to increase your credit limit as your business grows.

- Security: Working capital loans require businesses to pledge company assets as collateral. For vehicle lines of credit, the only collateral needed are the financed vehicles.

Line of Credit | Working Capital Loan | |

Access to Funds | Draw only what you need, when you need it | One-time lump sum |

Payment Structure | Payments based on amount used; flexible with cash flow | Fixed monthly payments on entire lump sum |

Approval Process | One-time approval for ongoing access | New application and approval for each borrowing request |

Interest Costs | Pay interest1 only on funds used for financed vehicles | Pay interest on entire borrowed amount from day one |

Renewal and Reassessment | Annual reviews; possible credit limit increase | Rarely reassessed; locked into initial terms |

Security | Financed vehicles serve as collateral | Company assets serve as collateral |

Now let's examine how a line of credit can be specifically applied to.

Fleet-specific credit lines

Not all lines of credit are the same. There are two types: general business lines of credit and fleet-specific lines of credit, such as GM Financial’s Commercial Line of Credit. Both share similar advantages over traditional financing but differ in important ways.

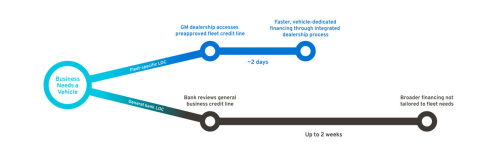

GM Financial’s family relationship with GM dealers creates a direct connection between you and your preferred dealership. When your business needs a new vehicle, you simply select it at the dealership, and the dealer accesses your preapproved credit line without additional approval processes. General bank lines of credit are still faster than traditional loans, but the dealership connection can make for a more seamless buying experience.

1For GM Financial customers, prevailing GM Financial standard retail APR and lease rates apply.

Another difference is in how funds are used. A typical business line of credit offered by banks allows businesses to cater to diverse needs, from payroll to overhead. GM Financial's line of credit is dedicated to vehicle acquisition and related fleet expenses.

A dedicated funding source for your vehicles allows for tailored financing that can benefit your business in the following ways:

Financial advantages

- Preserved working capital: A dedicated funding source for vehicles keeps your cash available for other operational needs, improving overall liquidity and creating a financial buffer during revenue fluctuations.

- Cost efficiency: You pay interest1 only on amounts used on financed vehicles rather than predetermined lump sums, potentially reducing your overall financing costs.

- Tax optimization: Interest payments are typically tax-deductible business expenses, so the flexible draw schedule enables strategic timing of expenses for tax planning.

- Asset-backed security: Using vehicles as collateral can secure more favorable terms than unsecured financing while building equity in your fleet.

Operational benefits

- Rapid response to vehicle needs: Preapproved financing enables immediate replacement of

broken-down vehicles or quick expansion for new contracts. - Maintenance optimization: Improved cash flow allows for timely preventive maintenance and repairs, reducing costly downtime and extending vehicle lifespans.

- Enhanced vendor relationships: Guaranteed payment capabilities strengthen your negotiating position with dealerships and service providers, potentially securing volume discounts or priority service.

- Fleet standardization: Consistent financing supports strategic purchasing of uniform vehicles, creating maintenance efficiencies and strengthening brand identity.

Strategic business benefits

- Seasonal adaptation: Specialized fleet credit lines enable strategic vehicle acquisition during slower periods and repayment during peak seasons.

- Growth enablement: Readily available financing allows pursuit of expansion opportunities when they arise rather than when traditional financing timelines permit.

- Business cycle alignment: Adaptable repayment options match financial obligations to your business's natural seasonal patterns.

- Fleet optimization: Replace vehicles at optimal times rather than based solely on cash availability, potentially reducing your total cost of ownership.

- Risk management: Immediate access to capital for unexpected replacements minimizes operational disruptions and vehicle downtime.

Now that we’ve discussed the financial, operational and strategic advantages of a fleet line of credit, how do you take the next step and apply?

Applying for fleet cash flow solutions

Securing approval for your fleet credit line is a critical turning point for your business. Understanding the application process and thorough preparation can mean the difference between approvals and declines.

General approval requirements

Many lenders evaluate applications based on financial and credit criteria, such as:

- Credit profile: A minimum credit score of 600-650, with 700+ typically securing the best terms.

- Business history: At least two years of documented profitable operations.

- Revenue threshold: Annual revenue of $250,000 or higher (with $500,000+ preferred).

- Financial health indicators: Debt-to-income ratio below 45%; positive cash flow for the past three quarters.

- Fleet utilization metrics: Evidence of efficient vehicle usage rates above 60%.

Your credit history carries significant weight in the approval process. A track record of consistent, on-time payments can improve your interest rate1 and lead to substantial annual savings.

GM Financial Commercial Line of Credit specific requirements

The GM Financial Commercial Line of Credit has more specialized requirements, reflecting its focus on comprehensive fleet management solutions.

Financial qualifications

For GM Financial, the Line of Credit minimum is $350,000, and businesses must demonstrate a strong business credit profile and show the ability to manage a significant fleet operation. These financial thresholds reflect the program's focus on established businesses with substantial fleet needs.

Fleet requirements

Your application must include a clear statement of primary vehicle use, projections of vehicle purchases for the next 12 months and information about your total fleet size. This detailed fleet information helps tailor the credit line to your specific operational needs.

Application success factors

A construction company that secured a $750,000 GM Financial Commercial Line of Credit attributed its success to presenting three years of increasing profitability alongside a detailed vehicle acquisition schedule tied directly to confirmed projects. The company coordinated with its accountant to ensure financial presentations highlighted cash flow patterns that aligned perfectly with its projected credit usage.

Applications that secure approval with the most favorable terms typically demonstrate:

- Clean financial presentation: Error-free, professionally prepared financial statements that clearly communicate business health.

- Compelling business narrative: A clear story of how the credit line will drive business growth.

- Well-defined fleet strategy: Documentation showing intentional vehicle acquisition and planning.

- Solid repayment capacity: Demonstrated ability to manage credit obligations through multiple business cycles.

An application can be rejected for several reasons. Inadequate cash flow, excessive debt, insufficient business history, poor credit history and vague utilization plans are among the most common.

This all takes time, but it’s worth the effort. A well-prepared and strategically focused application will both improve your approval odds and secure terms that support the growth of your business.

Part 2: Implementation and optimization

With a solid foundation in place, this section focuses on practical application. Here you’ll learn proven strategies for leveraging your fleet credit line to drive growth, strengthen business credit and make informed decisions about other financing options.

Using fleet lines of credit effectively

The potential of your fleet credit line goes beyond emergency funding. Used proactively, it can be a powerful driver of business growth, providing capital for strategic initiatives that might otherwise be out of reach.

What would take your business to the next level? Maybe it’s a market expansion that requires more vehicles. Or enhancing efficiency through technology upgrades like fuel cards or telematics. Whatever dreams you have for your business, a fleet line of credit can help you accomplish them.

Imagine a regional plumbing company that transformed from a local operation into a multicounty powerhouse by using a $500,000 credit line to double its fleet size over 18 months. Instead of taking on the fixed payments of traditional financing, the company added vehicles only as its secured new contracts. This approach resulted in a 40% revenue increase without straining cash flow during its growth phase.

1 For GM Financial customers, prevailing GM Financial standard and fleet APR and lease rates apply.

Get serious about strategy

Stories like these don’t happen by accident. A reactive posture toward fleet management won't be enough. Leveraging the power of a line of credit requires disciplined management. It’s a tool that needs to be used with precision, where each dollar is spent strategically.

Start with the end and work backward. Your business dreams need actionable goals. Those goals require vehicles, and those vehicles need funding. And to reach your goals, that funding must be tracked and prioritized.

Goals should be flexible, so it’s important to balance your credit line usage with actual earnings. Establish a rhythm of quarterly reviews to update your goals and adjust your draws accordingly. Most importantly, make consistent, on-time payments to build business credit and maintain favorable terms with your financing partner.

Avoiding common pitfalls

The most common mistake businesses make is overdrawing their credit line or consistently exhausting the available credit. This signals financial stress to lenders and can lead to reduced limits or less favorable terms during reviews.

Another pitfall is creeping interest. Credit line interest may seem small compared to the immediate benefit, but the costs accumulate over time. Set internal limits below your approved credit limit so you don’t rely too heavily on borrowed funds.

Finally, keep a separation between fleet expenses and general business expenses. Save your bank lines of credit for other business expenses while using a fleet credit line to fund your transportation needs. This will help you stay focused on vehicle-related growth opportunities. It will also bring more clarity to your financial reporting, making it easier to track fleet performance and increase efficiency.

Don’t do it alone

Getting the most out of your line of credit takes more time and energy than many business owners have. It's imperative that you develop a spending strategy and manage your funds with intention. If you have the resources, hire a fleet manager to take that off your plate. If you can’t do that, consider bringing in an outside fleet expert to help you create and execute a strategy that fits your business. Whatever you choose to do, don’t do it alone.

Building business credit through fleet lines of credit

A fleet credit line isn't just for buying vehicles. It's a powerful tool for building your business credit. When you manage it well, you're not just getting access to cash; you're setting yourself up for better financing down the road.

Strong business credit means better terms, higher limits and lower interest rates.1 For example, a savings of 3%-5% on interest rates can make a huge difference. On a $500,000 fleet expansion, that could mean $15,000-$25,000 less in interest payments each year.

Building credit takes patience and consistency. Use your fleet credit line thoughtfully, not just when emergencies strike, and you'll likely create more opportunities for your business.

GM Financial’s Commercial Line of Credit provides access to multiple financing products that help you build credit, all under a single credit line. Whether you choose an open-end or closed-end lease, traditional or Fleet APR financing, it’s a comprehensive solution with several unique advantages:

- Customization: Choose different financing approaches for different vehicles within your fleet based on their specific purpose, projected usage and expected lifecycle.

- Streamlined administration: Manage diverse financing approaches through a single relationship, reducing your administrative burden.

- Adaptability: Modify your financing strategy for specific vehicles as your business evolves without establishing new financing relationships.

- Flexibility: Finance both new and pre-owned vehicles through a single solution.

Making the right choice

Building strong business credit requires smart financing choices. Consider this four-step approach to finding the right financing mix for your fleet:

- Determine your fleet composition and usage

- How diverse are your vehicle types and their applications?

- Do you use both specialized and standard vehicles?

- Do you use both new and pre-owned vehicles?

- How frequently do your vehicle needs change?

- Cash flow considerations

- Is your revenue steady or does it fluctuate seasonally?

- How important is preserving monthly cash flow?

- Do different vehicle categories have different financial impacts?

- How predictable are your vehicle replacement life cycles?

- Growth and expansion plans

- Are you planning immediate expansion or gradual growth?

- How important is preserving borrowing capacity for other business needs?

- Is your growth pattern predictable or opportunistic?

- How quickly do you need to access financing for new vehicles?

- Potential tax implications 2

- How valuable are depreciation benefits to your business?

- Does your tax situation favor operational expenses or asset ownership?

- Is keeping debt off your balance sheet a priority?

- How do financing choices affect your financial ratios and statements?

Real-world applications

Different businesses choose to leverage various financing approaches based on their specific needs:

- A landscaping company with 30 vehicles rents seasonal equipment (minimizing off-season costs) while purchasing core vehicles used year-round. This approach optimizes cash flow management while building equity in essential assets.

- An HVAC company implements a tailored strategy to purchase specialized service vehicles with custom upfits, purchase pre-owned vehicles for apprentices and lease vehicles for sales staff. Each decision aligns with the specific purpose and projected lifecycle of each vehicle category.

- A plumbing business balances ownership and flexibility by purchasing 50% of its fleet while maintaining lease arrangements for high-mileage emergency response vehicles, allowing the business to quickly adjust its fleet composition as service demands evolve.

Impact on business credit

Your financing choices affect your credit-building strategy in different ways:

- Lines of credit demonstrate your ability to manage revolving credit responsibly.

- Traditional loans establish your capacity to maintain consistent long-term payments.

- Lease arrangements show your ability to effectively manage operational cash flow.

- Comprehensive solutions demonstrate sophisticated financial management capabilities.

By strategically selecting the right financing mix for your specific business needs, you create both operational advantages and credit-building opportunities that position your company for future growth.

Transforming fleet operations through strategic financing

A business line of credit for your fleet can be a game changer. Throughout this guide, you’ve seen how it works and how to use it effectively. The bottom line? It’s about more than having access to cash. It's about making your business more resilient and ready for growth.

The most successful businesses don't view their fleet financing as separate from their overall strategy. Instead, they see it as a key tool that helps them stay competitive in an ever-changing market.

Ready to put these ideas to work? Talk with financing experts who can help you develop a solution that fits your unique business needs.

1 For GM Financial customers, prevailing GM Financial standard and fleet APR and lease rates apply.

2 Always consult your tax adviser.